Wouldn’t it be nice if there was a mathematical equation that could predict and explain happiness? We could tweak the numbers and get happy! Sounds pretty far-fetched, right?

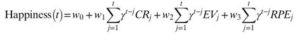

Actually this equation exists. It looks like this:

A researcher named Robb Rutledge, at the Max Planck University College London Centre for Computational Psychiatry and Aging Research, developed this equation. It figures that such an equation would be developed at an institution whose name is 12 words long! Rutledge developed this equation based on outcomes from a smart phone app called The Great Brain Experiment. The data was derived from 25,189 players of the app, a pretty good sample size!

Let me explain this equation to you. I will leave out the weird Sigma symbols and the small w constants and just explain the letters.

Basically, happiness depends on CR which stands for Certain Rewards or safe choices plus expectations associated with risky choices (EV, expected value), and the difference between the experienced outcome and the expectation which is called a reward prediction error (RPE).

So the key idea is that happiness doesn’t so much depend on how things are going, but how they are going compared to your expectations. Let’s use an example. You make plans to go to a new restaurant with your sweetie. You looked up the restaurant on various restaurant review sites, and it gets very positive reviews. You go to the restaurant and the meal is very good, but not quite as good as the reviews suggest. Your happiness decreases. Or you go to a restaurant that has mediocre reviews, and it’s actually pretty good. Your happiness goes up.

This may be why online dating is so difficult. People build up very high expectations of their potential date, based on photoshopped or out-of-date photographs, as well as email or chat communications that may represent an unrealistically positive view of the other person. When they meet the person their expectations are higher than reality, and they experience disappointment and unhappiness.

So the way to be happier is to have low expectations? Some researchers have suggested this is why Danish people are so happy. The Danes have a pretty good life, but they have lower expectations than people in many other countries, thus a higher level of happiness.

The only problem with this idea is that many choices in our life take a long time to reveal how they will work out, such as marriage and taking a new job or moving to a new city. Having higher expectations for these slow-to-reveal choices probably increases happiness, at least allows the person to hang in with the decision long enough to find out how it will work out.

In general, accurate expectations may be best. Of course, the challenge is how to have accurate expectations. Reading both negative and positive reviews of a restaurant or a product may help with this. But there’s no site that reviews your marriage or your current job so those kinds of choices may be more of a challenge.

The same researchers also looked at brain scans and figured out that it appeared that dopamine levels reflect happiness changes, higher dopamine comes from increased happiness and lower dopamine comes from disappointment.

There are some practical implications of this research.

- For choices that have immediate feedback such as a restaurant or a movie, temper your expectations. Maybe read more negative reviews so that your expectations are lower for the event. Then you can be pleasantly surprised when the restaurant or the movie is better than expected. This also applies to online dating.

- For choices that you don’t get quick feedback about such as long-term decisions like marriage or a job, have reasonably high expectations., Or at least try to have realistic expectations.

- Lower other people’s expectations of shared choices rather than hyping the choices. For example, let’s imagine you have recently seen a movie that you loved. Don’t tell your friends it was the best movie you’ve ever seen and that it will change their lives, instead tell them it was a pretty good movie and leave out all details. Same with restaurants, cars, and other choices that we make. Downplay rather than overhype.

Now I have to go because I have reservations at that new five-star restaurant after which I’m going to that wonderful new film, and then I’m moving to Denmark! Wish me luck.